Public Comments

October

2017

5

“PaydayFreeLandia” Coalition Statement on CFPB’s Payday Lending Rule

For Immediate Release: Tuesday, October 5, 2017

Contact: Andy Morrison, New Economy Project, 212-680-5100

“PaydayFreeLandia” Coalition Applauds Consumer Financial Protection Bureau’s Affirmation of Crucial State Consumer Protections as Long-Awaited Payday Lending Rule Is Released

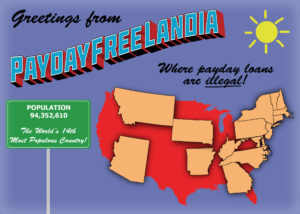

Today the Consumer Financial Protection Bureau (CFPB) issued federal regulations to protect people from the abusive payday lending industry. The “PaydayFreeLandia” Coalition – a group of civil rights, labor, faith-based and community organizations from the 15 states where predatory payday lending is illegal – issued the following statement:

“We commend the CFPB for recognizing the devastating harm that payday lending causes millions of Americans. Payday lenders charge borrowers excessive fees and shockingly high interest rates – typically between 300% and 400% – to ensnare them in a long-term cycle of debt. The CFPB clearly recognizes our states’ authority to keep payday lending out, and its new rule affirms that strong interest rate caps, like we have in our states, are the best defense against predatory payday lending.

“The CFPB’s rule states that:

[C]ertain States have fee or interest rate caps (i.e., usury limits) that payday lenders may find are set too low to sustain their business models. The Bureau regards the fee and interest rate caps in these States as providing greater consumer protections than, and thus as not inconsistent with, the requirements of the final rule.

The Bureau recognizes that States may wish to prevent more harms than are prevented by this rule, and they are free to do so because, as noted earlier, this rule should be considered a floor and not a ceiling.

“Strong state interest rate caps yield tremendous benefits for more than 90 million people who live in states that effectively ban predatory payday lending. Thanks to strong usury laws in 15 states, plus D.C., people in our states save $5 billion every year in fees that high-cost payday and car title lenders would otherwise siphon—an estimate that does not even include bank overdraft fees and other economic fallout from these triple-digit interest rate loans.

“As a result of pressure by the financial services industry, the 2010 Dodd-Frank law expressly bars the CFPB from setting interest rates. Without the authority to set interest rate caps, the CFPB took the next best step: it requires lenders to ensure that borrowers have the ability to repay loans, taking into account income and expenses. Unfortunately, the new rule contains problematic exceptions to this ability-to-repay standard, and other loopholes, that abusive lenders are likely to cash in on.

“We must end the payday loan debt trap, once and for all. Our coalition will continue to press the CFPB to crack down on illegal payday lending. We urge Congress to build on the CFPB’s rule by setting a strong national interest rate cap. Congress should not attack these new, modest protections for borrowers in states where high-cost lending is legal. The experience in our states clearly demonstrates that people are much better off without predatory payday loans.”