Public Comments

March

2022

28

Letter to NYC Public Banking Commission Calling for De-Designation of Wells Fargo

The Honorable Eric L. Adams

Mayor, New York City

City Hall

New York, NY 10007

The Honorable Brad Lander

Comptroller, New York City

One Centre Street

New York, NY 10007

The Honorable Preston Niblack

Commissioner, New York City Department of Finance

66 John Street, Room 104

New York, NY 10038

Dear Mayor Adams, Comptroller Lander, and Commissioner Niblack:

We, the undersigned 25 organizations, including members of the Public Bank NYC coalition, write to you in your roles as members of the NYC Banking Commission (“the Commission”) regarding the recent Bloomberg Businessweek investigation into Wells Fargo’s discriminatory mortgage lending practices.1 For the reasons outlined below, we call on the Commission to revoke unconditionally Wells Fargo’s designation to hold City deposits.

As you know, all banks designated to hold City deposits must file with the Commission “a certificate setting forth that the bank adheres and will continue to adhere to all equal credit opportunity laws and that its board of directors has established and will adhere to a policy of nondiscrimination in the bank’s delivery of banking services to all customers in New York City.”2

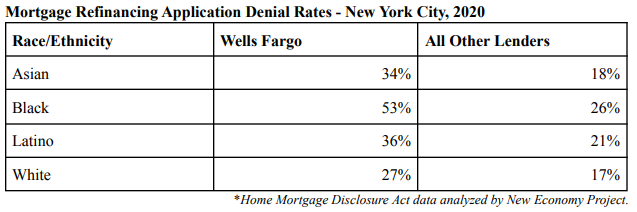

Yet, according to Bloomberg, Wells Fargo approved fewer than half of Black homeowners’ completed refinancing applications in 2020 – compared with 72% of white homeowners. New Economy Project analyzed federal Home Mortgage Disclosure Act data – the same data used by Bloomberg – for New York City and found deeper disparities still. As the data below show, across the five boroughs, Wells Fargo denied Black homeowners at a rate more than double that of all other lenders in 2020.

This alarming disparity – which indicates a clear violation of the City’s designation requirements – is only the latest in a long line of scandals and misconduct by Wells Fargo, and calls for unequivocal action by the Commission rescinding the bank’s designation.

In 2017, the Commission conditionally designated Wells Fargo as a depository, and the City began drawing down its accounts with the bank in response to a “double downgrade” of its Community Reinvestment Act (CRA) rating. In fact, racial and economic justice and environmental groups cited numerous rationales for removing Wells Fargo as a designated bank, including its funding of the Dakota Access Pipeline and flagrant violations of indigenous rights.3

Wells Fargo has long engaged in a dizzying array of discriminatory and unlawful activities, for which it has been penalized 220 times for a total of $22 billion since 2000.4 To name just a few recent examples:

- In 2018, the U.S. Consumer Financial Protection Bureau and Office of the Comptroller of the Currency (OCC) assessed a $1 billion penalty against Wells Fargo for charging borrowers improper fees to “lock” their mortgage interest rates.5

- In February 2021, the U.S. Department of Justice assessed a $3 billion penalty related to the bank’s notorious “fake accounts” scandal.6

- In September 2021, the OCC assessed yet another penalty of $250 million against Wells Fargo based on the bank’s unsafe and unsound banking practices related to its home lending loss mitigation programs and violations of an 2018 consent order meant to remedy these deficiencies.7

Notwithstanding these and other ongoing abuses by Wells Fargo, and ignoring further widespread opposition from New Yorkers, the Banking Commission decided last summer, in a rare 2-1 vote, that the City and its agencies could resume banking with Wells Fargo.8

The Commission must revoke Wells Fargo’s designation to hold City deposits. We further urge the Commission to determine whether other designated banks have failed to meet the City’s designation requirements and should therefore be prohibited from holding City deposits, pursuant to the City’s rules and regulations. The Bloomberg analysis of mortgage refinancing data shows striking racial disparities across all lenders nationally, with 70% of Black and 78% of Hispanic applicants being approved for mortgage refinances in 2020, compared with 87% of white applicants.

Finally, we urge you to support – and take concrete actions toward establishing – a municipal public bank. Wells Fargo’s latest scandal underscores the need for a public option for the City’s deposits. Through public banking, the City can leverage its vast resources to equitably invest in affordable housing and other critical needs in historically-redlined Black, brown, and immigrant communities – something Wells Fargo and other big banks fail to do.

Please contact Andy Morrison at New Economy Project (andy@neweconomynyc.org) or Chris Fasano at Mobilization for Justice (cfasano@mfjlegal.org) with questions.

Sincerely,

Action Center on Race and the Economy

Brooklyn Level Up (BKLVLUP)

Carroll Gardens Association

Center for Family Life

Chhaya Community Development Corporation

Citizen Action of New York

Communities Resist

Cooper Square Committee

East Flatbush Village

East New York Community Land Trust

Food & Water Watch

Hopewell Care Childcare Cooperative

Legal Services Staff Association, UAW Local 2320

Lower East Side People’s Federal Credit Union

Mobilization for Justice

New Economy Project

New York Communities for Change

NYC-DSA Debt & Finance Working Group

NYPIRG

Public Bank NYC

Sixth Street Community Center

Strong Economy for All

Teamsters Local 237 Legal Services Plan

The Working World

Woodside on the Move

1 https://www.bloomberg.com/graphics/2022-wells-fargo-black-home-loan-refinancing/

2 The Rules of the City of New York, Title 22: Banking Commission

3 https://actionnetwork.org/petitions/tell-the-nyc-banking-commission-to-defunddapl

4 Violation Tracker, Good Jobs First

5 https://www.consumerfinance.gov/about-us/newsroom/bureau-consumer-financial-protection-announces-settlement-wells-fargo-auto-loan-administration-and-mortgage-practices/

6 https://www.justice.gov/opa/pr/wells-fargo-agrees-pay-3-billion-resolve-criminal-and-civil-investigations-sales-practices

7 https://www.occ.gov/news-issuances/news-releases/2021/nr-occ-2021-95.html

8 https://www.gothamgazette.com/opinion/10524-new-york-city-back-in-bed-bad-bank-but-better-way-public