Action Alerts

August

2020

28

(Archive) Stop Trump Administration from Unleashing Predatory Payday Lending in NY

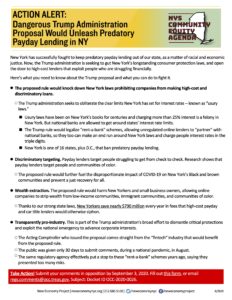

DANGEROUS TRUMP ADMINISTRATION PROPOSAL WOULD UNLEASH PREDATORY PAYDAY LENDING IN NY

New York has successfully fought to keep predatory payday lending out of our state, as a matter of racial and economic justice. Now, the Trump administration is seeking to gut New York’s longstanding consumer protection laws, and open the door to high-cost lenders that exploit people who are struggling financially.

Here’s what you need to know about the Trump proposal and what you can do to fight it.

The proposed rule would knock down New York laws prohibiting companies from making high-cost and discriminatory loans.

- The Trump administration seeks to obliterate the clear limits New York has set for interest rates — known as “usury laws.”

- Usury laws have been on New York’s books for centuries and charging more than 25% interest is a felony in New York. But national banks are allowed to get around states’ interest rate limits.

- The Trump rule would legalize “rent-a-bank” schemes, allowing unregulated online lenders to “partner” with national banks, so they too can make an end run around New York laws and charge people interest rates in the triple digits.

- New York is one of 16 states, plus D.C., that ban predatory payday lending.

Discriminatory targeting. Payday lenders target people struggling to get from check to check. Research shows that payday lenders target people and communities of color.

- The proposed rule would further fuel the disproportionate impact of COVID-19 on New York’s Black and brown communities and prevent a just recovery for all.

Wealth extraction. The proposed rule would harm New Yorkers and small business owners, allowing online companies to strip wealth from low-income communities, immigrant communities, and communities of color.

- Thanks to our strong state laws, New Yorkers save nearly $790 million every year in fees that high-cost payday and car title lenders would otherwise siphon.

Transparently pro-industry. This is part of the Trump administration’s broad effort to dismantle critical protections and exploit the national emergency to advance corporate interests.

- The Acting Comptroller who issued the proposal comes straight from the “fintech” industry that would benefit from the proposed rule.

- The public was given only 30 days to submit comments, during a national pandemic, in August.

- The same regulatory agency effectively put a stop to these “rent-a-bank” schemes years ago, saying they presented too many risks.

TAKE ACTION! Submit your comments in opposition by September 3, 2020. Fill out this form, or email regs.comments@occ.treas.gov, Subject: Docket ID OCC-2020-0026.