Press Releases

February

2018

14

60 Groups Call on NYS Senate and Assembly Leadership to Tackle Neighborhood Poverty and Bank Redlining in Budget

FOR IMMEDIATE RELEASE: February 14, 2018

Broad-Based Coalition Urges NYS to Appropriate $25 Million to Community Development Financial Institutions in Face of Trump’s Proposal to Zero Out Federal Funding

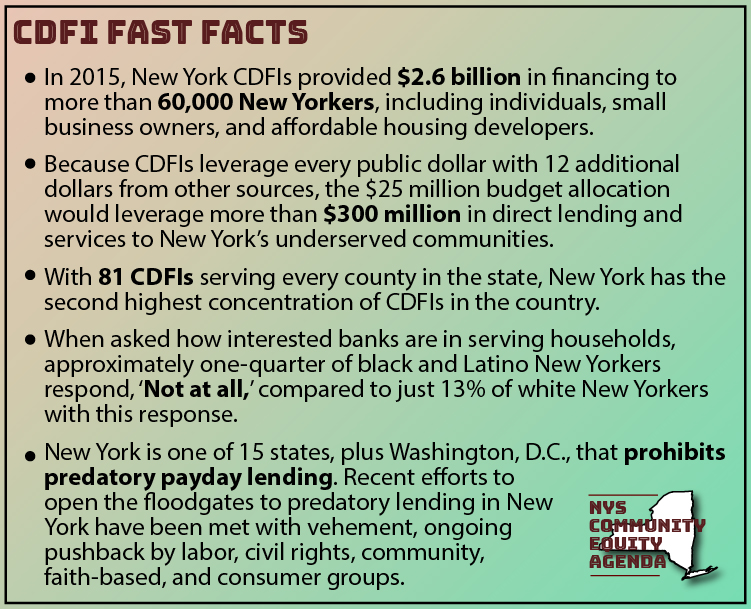

Sixty civil rights, labor, community, and faith-based groups and community development credit unions from all corners of the state sent an urgent letter to New York State Senate and Assembly leadership this week, calling for a $25 million appropriation to the New York State Community Development Financial Institution Fund (NYS CDFI Fund) in this year’s budget.

Click here to read the letter and view the full list signatories.

New York State established the NYS CDFI Fund in 2007—modeled on the successful federal CDFI Fund—to provide grants and investments to New York CDFIs, which serve New Yorkers and small businesses in economically-distressed communities throughout the state. New York’s was the first state-based CDFI Fund in the country. The NYS CDFI Fund, however, has yet to receive any funding from the state.

“Our credit union and other CDFI credit unions around the state stand ready to deploy this money where it is needed most,” said Melissa Marquez, CEO of Genesee Co-op. “This $25 million allocation to provide grants and investments to New York’s CDFIs would generate hundreds of millions of dollars in the form of loans and services to build affordable housing, create jobs, grow small businesses and worker co-ops, and expand access to equitable financial services in New York’s low-income communities.”

New York’s CDFIs provide equitable financial services in neighborhoods not served by mainstream banks, helping low-income New Yorkers establish savings and credit, and build wealth. CDFIs also support New York’s small businesses – the economic lifeblood of many low-income and immigrant neighborhoods and neighborhoods of color – providing vital loans, investments, financial services, and financial counseling.

“Strong state support for CDFIs—including neighborhood-based financial cooperatives—represents a critical counterweight to recent efforts to legalize predatory payday and other high-cost lending in New York,” said Andy Morrison of New Economy Project. “Sound, affordable financial services should be available to all New Yorkers, and low-income New Yorkers, immigrants, and New Yorkers of color shouldn’t be shunted to exploitative financial services that systematically strip wealth from New York communities.”

This week, the Trump Administration again proposed eliminating the federal CDFI Fund’s discretionary grant and direct loan programs—slashing its overall budget by $234 million, a nearly 95% reduction. State funding is now more important than ever. Governor Cuomo’s budget proposal did not include funding for CDFIs; groups are looking to the NYS Legislature to make this a major priority in the upcoming budget negotiations.

“Our community’s CDFI isn’t just the only banking option for many of our most financially marginal neighbors,” said Rob Brown of the Tompkins County Workers’ Center. “It provides financial health services. It provides accessible education for (aspiring) entrepreneurs on how to manage business finance, legal obligations when becoming an employer, how to budget for Living Wage pay and more. They study area costs of living and make that information free to the public, empowering labor and other community advocates as we work for fair pay standards. Funding CDFI programs is an important part of changing systemic economic disenfranchisement and has direct results.”

“CDFIs play a vital role for our members and employer partners, making it possible for New Yorkers, regardless of socioeconomic status or cultural background, to achieve financial independence for themselves and their families,” said Jose Ortiz, Jr., Executive Director of the New York City Employment and Training Coalition. “The New York City Employment & Training Coalition exists to ensure that every New Yorker has access to the skills, training, and education needed to thrive in the local economy. Through our over 180 member organizations, we are achieving this mission for almost one million New Yorkers each year.”

“Funding CDFIs is a great start to filling the service gap left by mainstream banks in low-income neighborhoods and communities of color, without resorting to predatory, payday-loan-like products,” said Ariana Lindermayer of Mobilization for Justice, for New Yorkers for Responsible Lending.

“At the NYC Anti-Violence Project, we know that LGBTQ and HIV-affected survivors of violence, particularly survivors who are people of color, are financially impacted in the wake of violence,” said Teal Inzunza, LMSW, Coordinator of the Economic Empowerment Program at the NYC Anti-Violence Project. “Often, banks discriminate against the community we serve and don’t give access to needed loans or services. We believe that because CDFI’s are community centered, they will greatly benefit the community that we serve. We welcome this vital initiative to bring economic empowerment opportunities to LGBTQ and HIV-affected communities.”

The proposal to fund the NYS CDFI Fund is part of a comprehensive Community Equity Agenda, a legislative platform to advance financial justice and community-led development in low-income and immigrant communities and communities of color in New York State.

# # #