NYS Community Equity Agenda

About the Community Equity Agenda

The NYS Community Equity Agenda calls for policies and actions that transform, rather than merely reform, our fundamentally unjust social, political and economic systems. It puts racial and economic justice front and center and addresses long-standing inequities that play out at neighborhood and regional levels. It requires decision-making led by people and communities typically left out of, and harmed by, status quo economic development.

Tackling our most existential crises – from climate devastation to persistent wealth inequality – requires transformational change. In the face of federal attacks on low-income people, immigrants, women, and people of color, the need for bold, local action has never been greater.

The Agenda is driven by a broad-based coalition of community, labor, civil rights, and legal services groups, cooperative organizations, and community development financial institutions (see list below). It sets forth an affirmative, solutions-oriented platform, focusing on concrete legislative and regulatory changes that New York can and should make right now to:

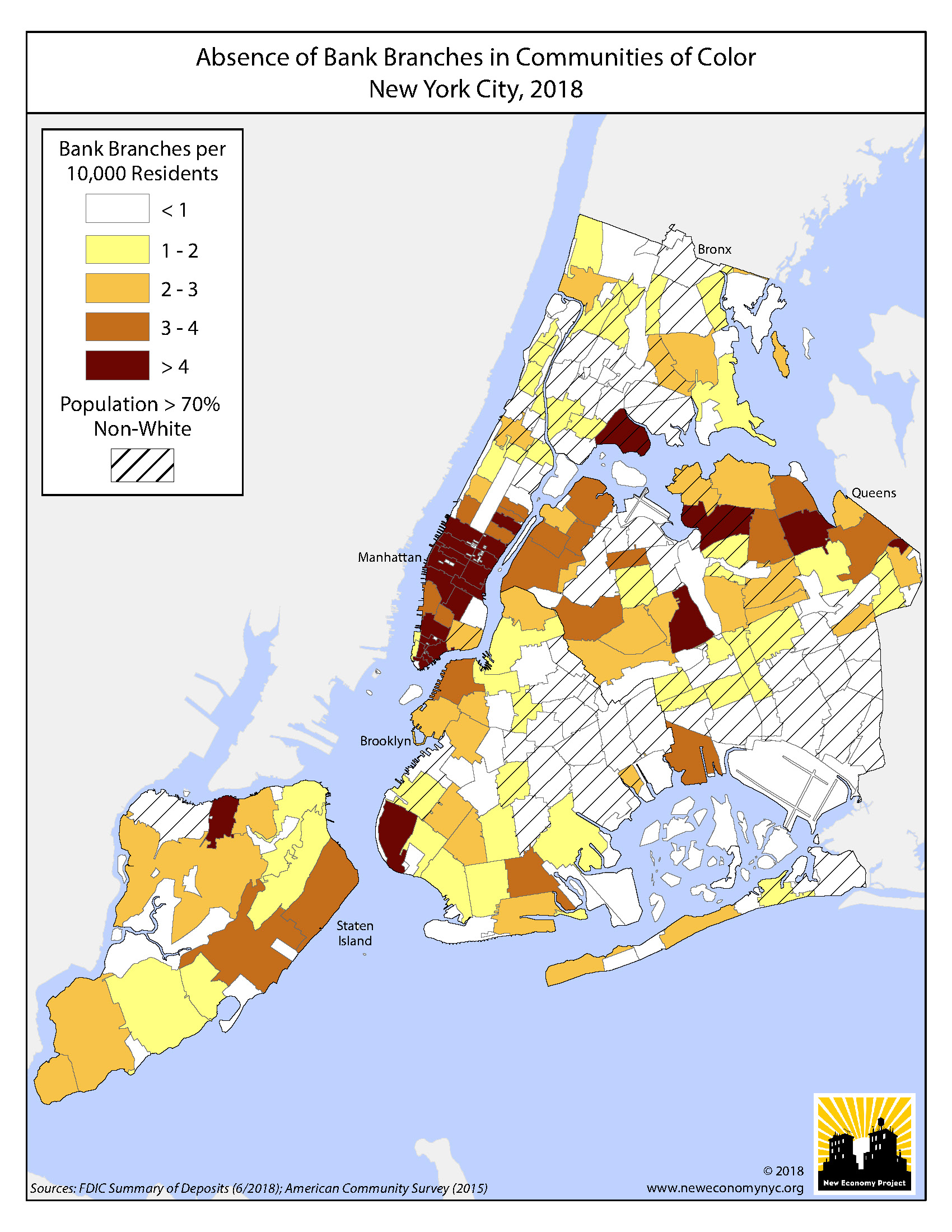

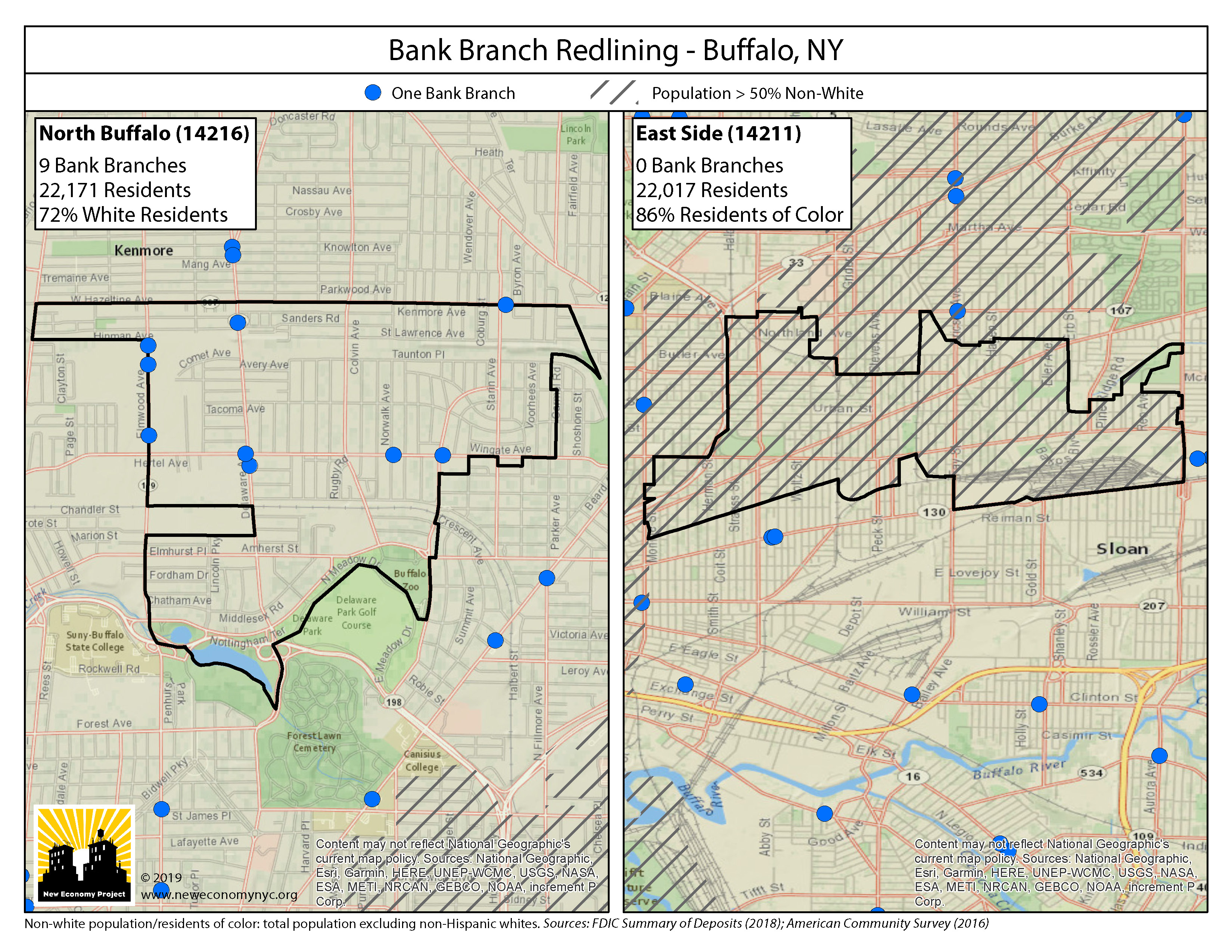

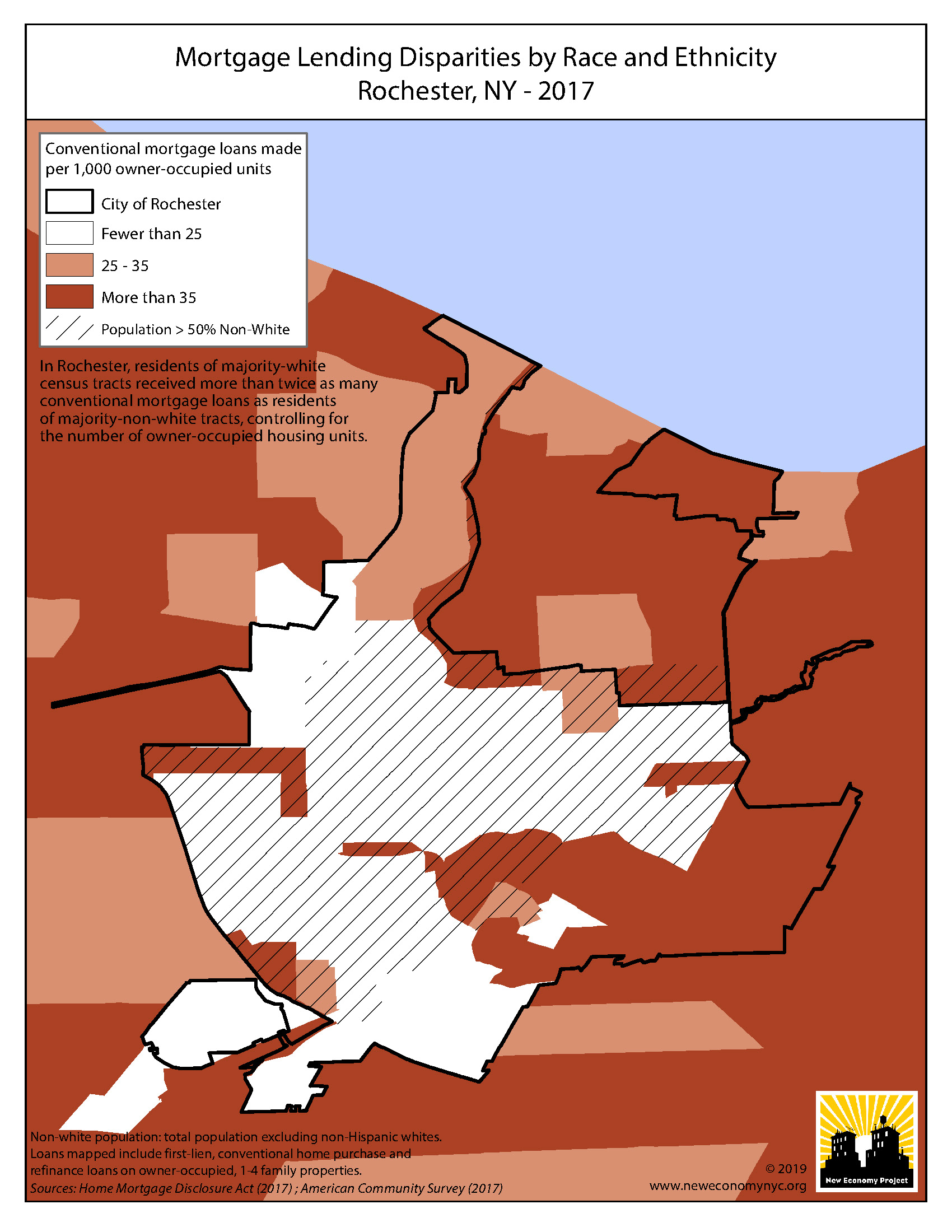

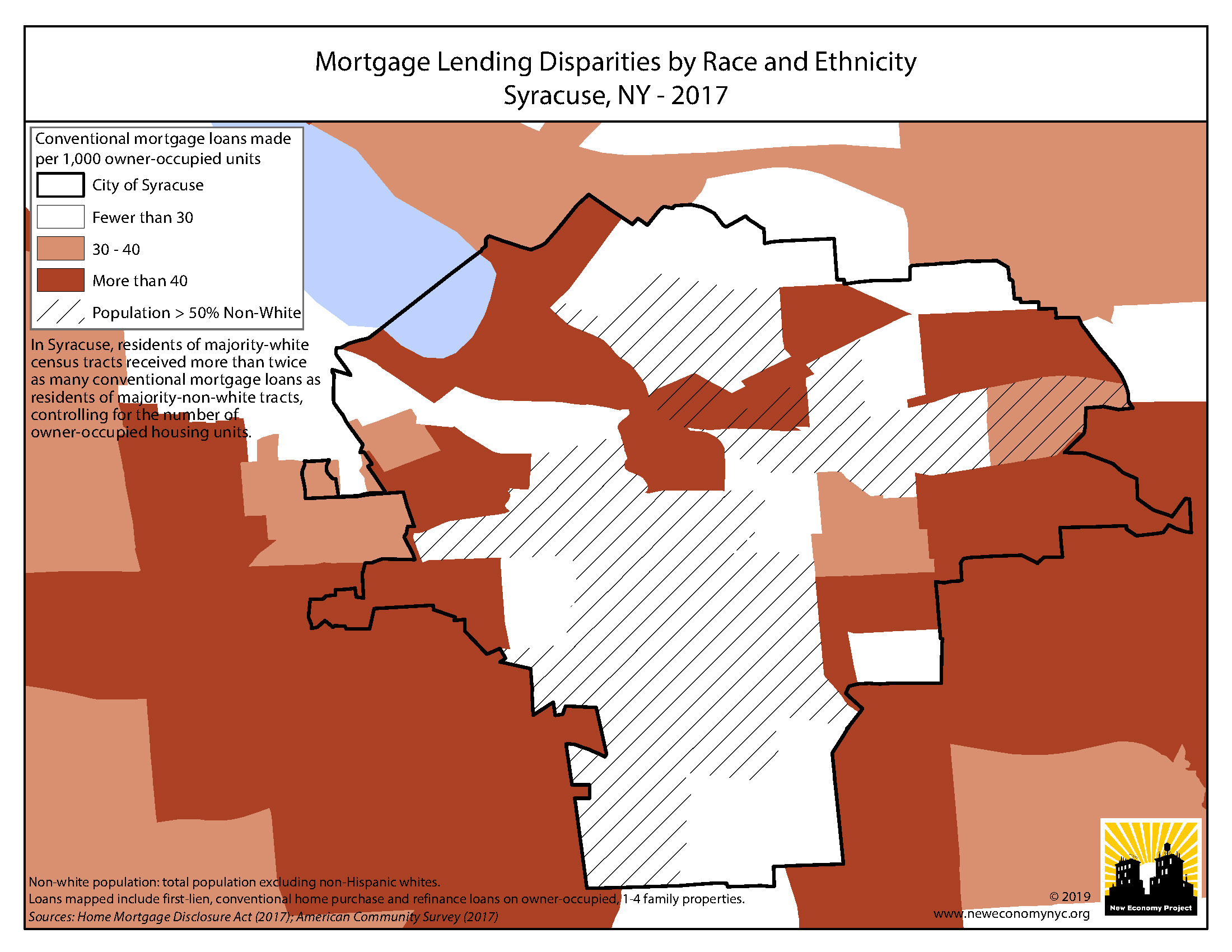

- Build community wealth. To jumpstart economic growth in New York’s low-income communities and communities of color, New York should support cooperatively-structured and community-led development. We must strengthen community-based financial institutions, including mission-driven financial co-ops that serve historically-redlined communities. The state must ensure a living wage and a collective voice on the job for all New Yorkers. To address the housing crisis, New York should foster the growth of community land trusts (CLTs) and non-speculative housing models that ensure long-term and deep affordability.

- Divest and invest. Public money should be used for the public good, not for private gain. New York should divest public deposits from banks that actively harm New Yorkers and destabilize neighborhoods, and that finance fossil fuels and other destructive industries. Instead of placing billions of public dollars on deposit with Wall Street banks, New York should establish state and municipal public banks that invest in low-income communities and communities of color. Grassroots and nonprofit initiatives that advance equitable economic development – including worker, food, and financial co-ops, CLTs, community-controlled renewable energy initiatives, and much more – should be prioritized over massive subsidies and tax breaks to large corporations.

- End wealth extraction. We must end the systematic extraction of wealth from New York communities. New York State has long banned payday lending through its strong usury laws. For years, however, the payday lending industry and other financial predators have sought to break into New York’s lucrative market, trying to blast open the state’s usury laws. Instead of opening floodgates to high-cost, predatory loans, we should stand firmly behind our strong usury laws and strengthen other consumer protection laws, as needed. An immediate first step is to update New York’s woefully antiquated unfair and deceptive acts and practices law.

2019/2020 Policy Priorities:

1. Build community wealth by funding the NYS Community Development Financial Institutions Fund. The Governor and NYS Legislature should deliver on funding for the NYS Community Development Financial Institutions Fund in the state budget, and enact policies to dramatically expand the reach of community development credit unions (CDCUs).

2. Promote economic democracy by establishing a New York worker-ownership center. To help create jobs with dignity statewide, New York should establish a worker-ownership center, as a first step towards workplace democracy. The center should provide technical assistance and other needed support to worker co-ops and businesses converting to worker ownership.

3. Keep predatory lending out of New York and prevent further siphoning of wealth from New Yorkers and communities of color. The Governor and NYS legislators must reject any attempt – whether from check cashers, online “fintech” lenders, or other financial services entities – to weaken, undermine, or exempt companies from our vital anti-predatory lending laws. New York is one of 16 states that bans predatory payday lending.

Click here for highlights from 2019 NYS legislative session.

Click here for highlights from 2018 NYS legislative session.

Members*

Banana Kelly Community Improvement Association

Brooklyn Cooperative Federal Credit Union

CAMBA Legal Services

Chhaya CDC

Center for NYC Neighborhoods

Consumer Reports Advocacy

Cooperation Buffalo

Cooperative Federal Credit Union

DC-37

Genesee Co-op Federal Credit Union

Inclusiv

Latino Justice PRLDEF

The Legal Aid Society

Legal Services Staff Association, LSSA 2320, UAW/NOLSW 2320

Long Island Housing Services

Long Island Progressive Coalition

Lower East Side People’s Federal Credit Union

Mobilization for Justice

New Economy Project

NYC Network of Worker Cooperatives

New York Working Families

New Yorkers for Responsible Lending

OWN Rochester

Pan-African Community Development Initiative

RWDSU

The Black Institute

US Federation of Worker Cooperatives

Western New York Law Center

*list in formation

Join the NYS

|

Latest News & Updates

- How Financial Co-ops Are Helping Puerto Rico Rebuild — and Why It Matters for New York

- City Limits: NY Can Reduce Redlining’s Residue by Backing Credit Unions

- Action Alert: Stop Predatory Financial Services Bill, June 19, 2019

- Albany Drops the Ball on Community Development

- Buffalo News: Advocates Urge State Officials to Help Close Gap in Access to Capital

Resources

Video

|

CDFI Profile – Brooklyn Cooperative Federal Credit Union Learn about what makes Brooklyn Cooperative Federal Credit Union different from most other financial institutions. |

New York State Equity Agenda – Caucus Weekend 2019 Hear from members of the Equity Agenda coalition and elected officials on the need for a new approach to economic development in New York. |