Public Comments

February

2019

14

Testimony Before the NYC Council Committee on Consumer Affairs and Business Licensing, on Cashless Business Legislation

TESTIMONY OF JULEON ROBINSON, PROGRAM ASSOCIATE NEW ECONOMY PROJECT

To the NYC Council Committee on Consumer Affairs and Business Licensing

February 14, 2019

Thank you Committee Chair Espinal and other members of the Committee for the opportunity to testify today. My name is Juleon Robinson and I represent New Economy Project, an economic justice organization that works with community groups and low income New Yorkers throughout New York City.

New Economy Project’s mission is to build a just economy, based on cooperation, racial, economic, and gender justice, and ecological sustainability. Since our organization’s founding in 1995, we have worked with hundreds of grassroots groups to challenge Wall Street banks and other corporations that harm New Yorkers and perpetuate poverty, inequality, and segregation. We also work with groups to build democratically-structured, community-controlled initiatives, including community land trusts and mutual housing, worker and financial co-ops, and more.

New Economy Project supports Intro. 1281, sponsored by Council Member Ritchie Torres, prohibiting retail establishments from refusing to accept payments in cash. The emerging trend by some businesses to no longer accept cash payments is disturbing on many fronts: It has a discriminatory impact on low-income New Yorkers who face barriers to fair banking access, and people who reside in communities of color that banks continue to redline; it promotes a shift to inferior and poorly-regulated digital payment, prepaid cards, and other non-bank services; and it requires people to cede even more personal information to large companies, exposing them to privacy and surveillance risks.

This morning, I will focus on the following:

- Persistent bank redlining in NYC neighborhoods of color;

- Concerns about financial technology (fintech) companies and the emerging cashless economy; and,

- The need for bold solutions to address our two-tiered financial system, which serves to perpetuate poverty, inequality and segregation in NYC.

Persistent Redlining In NYC Neighborhoods Of Color

Cashless retail outlets effectively reinforce the systemic inequities in our financial system and economy at large. They present New Yorkers who live in redlined communities with two bad options: either purchase a high-cost, under-regulated financial product, like a prepaid card, or be left unable to make purchases at all.

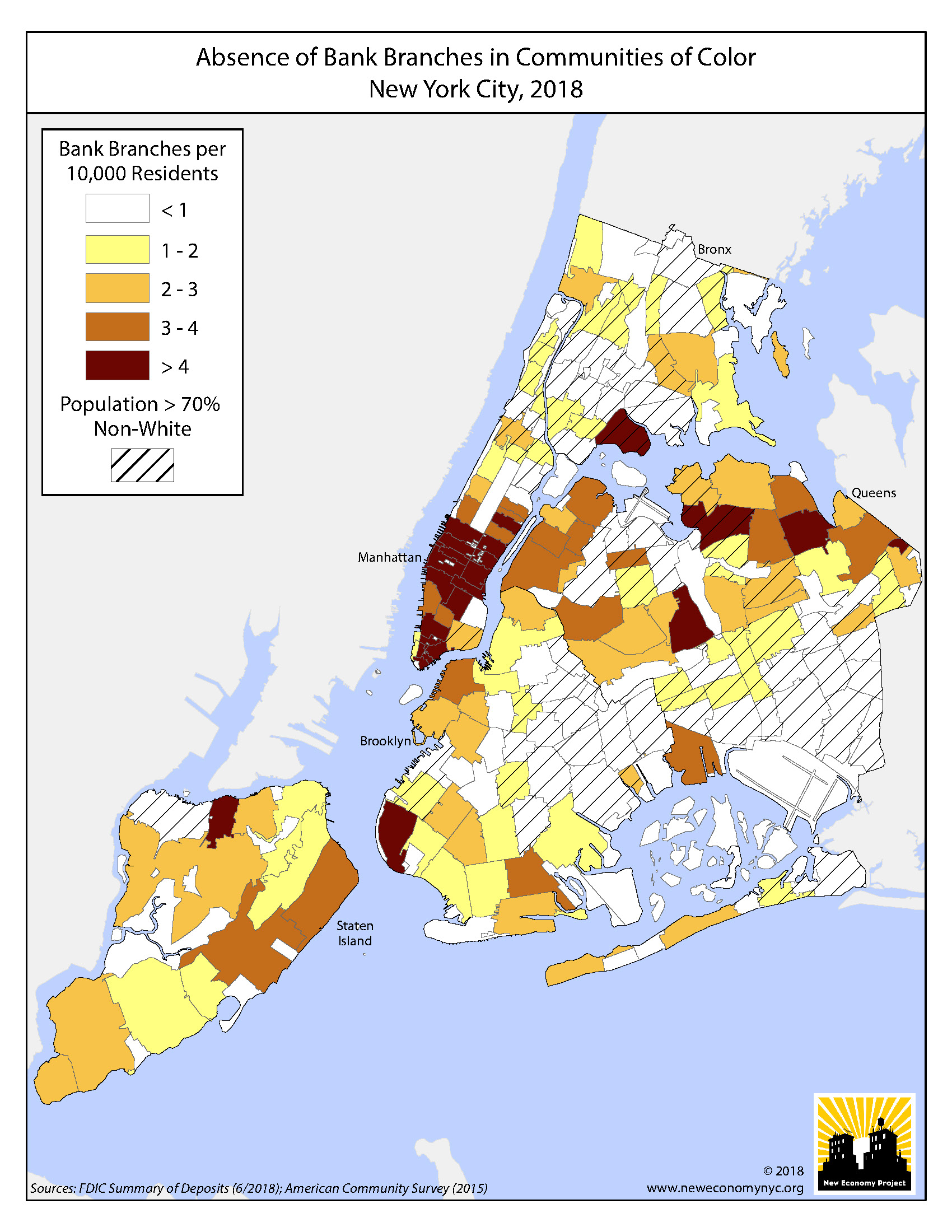

As the attached map shows (see Map 1), there is a glaring lack of bank branches in New York City’s communities of color. The map controls for neighborhood population, showing the number of bank branches for every 10,000 people. The diagonal lines, or cross-hatching, correspond to neighborhoods in which more than 70% of the population identifies as a person of color, which includes black, Latino and Asian New Yorkers.

In NYC neighborhoods of color there is just one bank branch, on average, for every 10,000 residents, compared to 3.24 branches for every 10,000 residents in all other NYC neighborhoods.1 Many communities of color in central Brooklyn, Southeast Queens, and the South Bronx have access to less than one bank branch per 10,000 residents. Some zip codes have no branches at all.

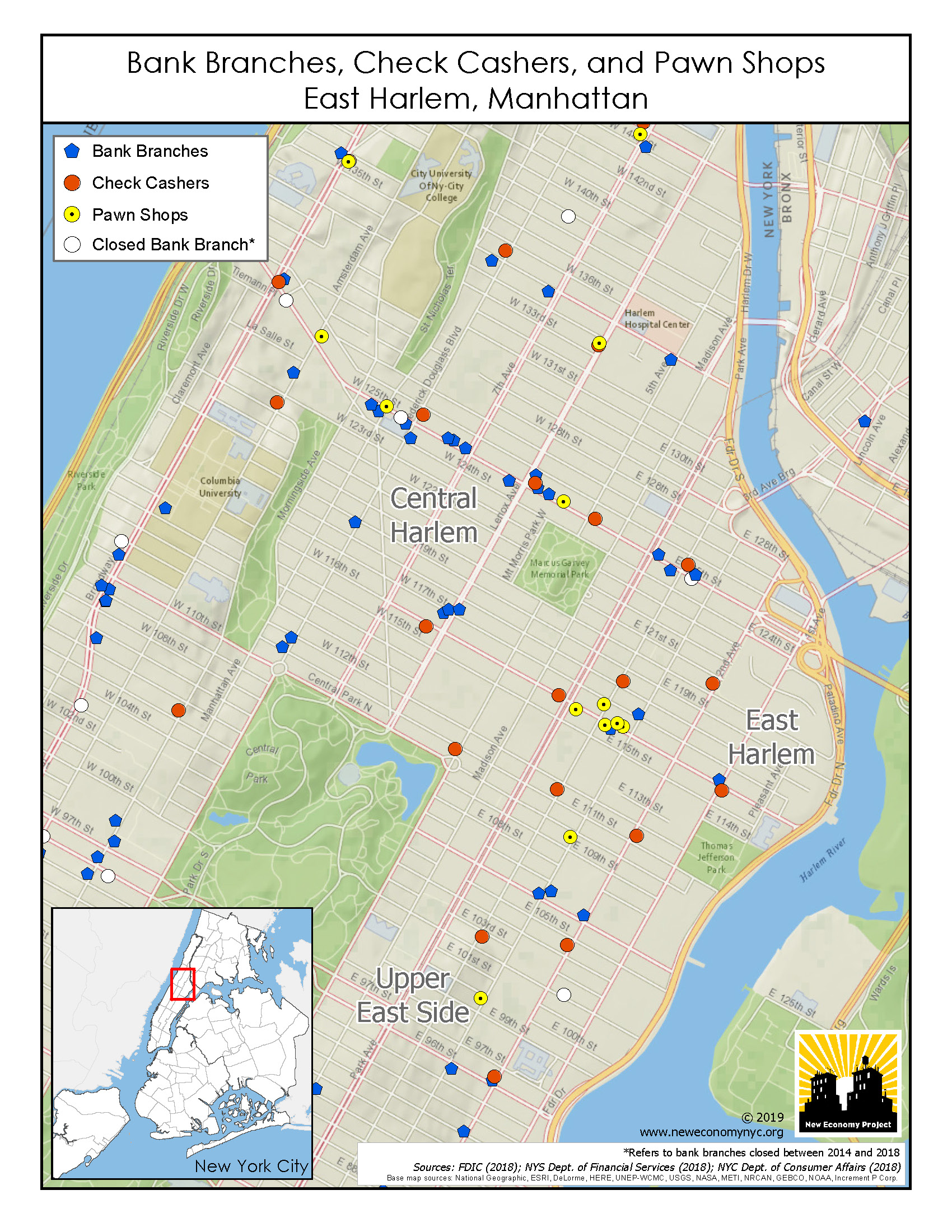

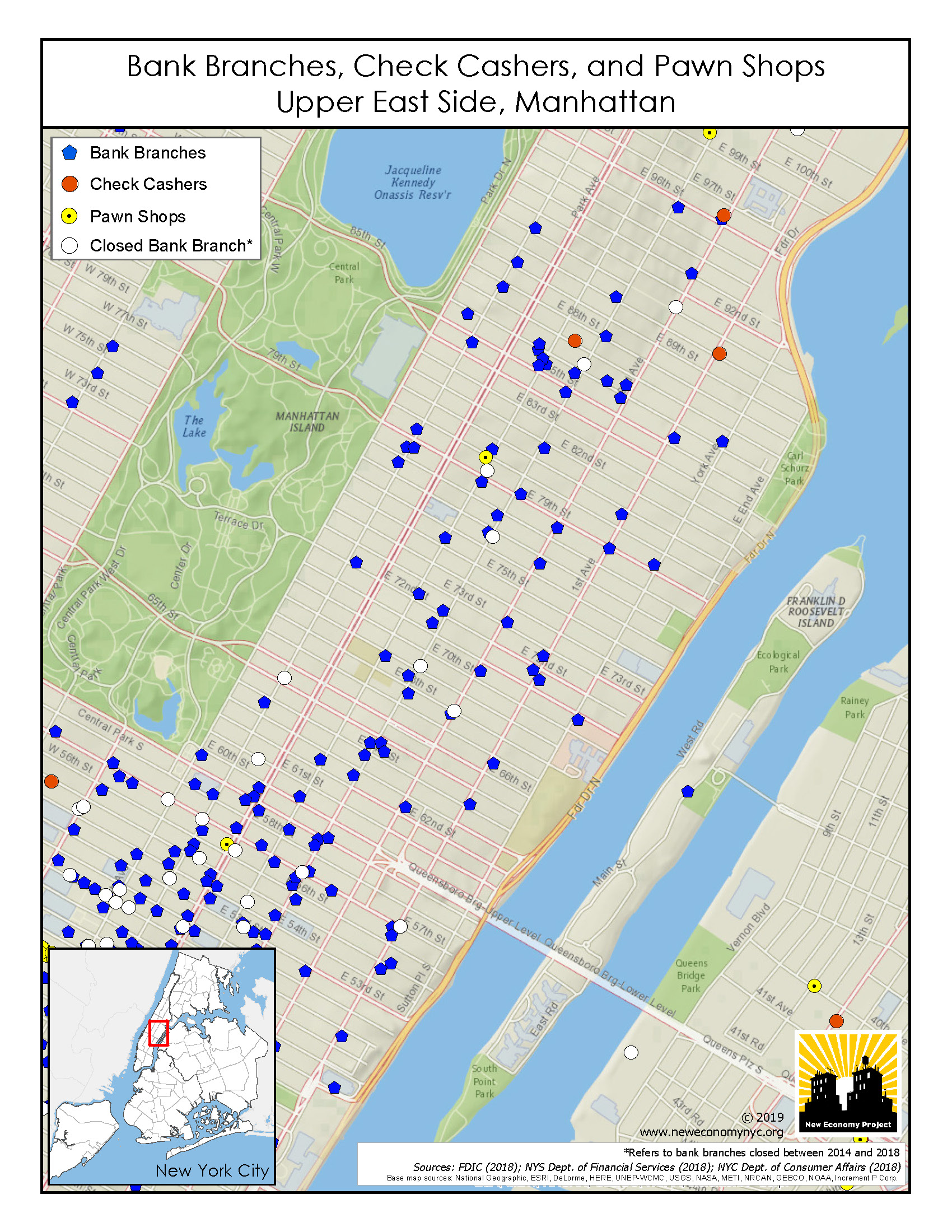

The next two attached maps (see Maps 2 and 3) beam down to the neighborhood level, comparing two neighborhoods in Manhattan that illustrate the extreme income inequality in our city: Manhattan’s Upper East Side and East Harlem. Every blue marker represents a bank branch, red dots are for check cashers, and pawnshops are yellow. As Map 3 illustrates, when banks fail to serve neighborhoods adequately—or at all—high-cost, fringe financial services like check cashers and pawn shops fill the vacuum.

Banks’ failure to locate branches in communities of color contributes to huge disparities in the use of bank services by black and Latino households compared to white households. When asked how interested banks are in serving households like theirs, approximately one in four black and Latino New Yorkers responded, ‘Not at all,’ compared to just 13% of white New Yorkers who gave this response.2

People excluded from the banking system incur not only immediate financial costs, but also long-term setbacks. Lack of a banking or credit history, in particular, can unfairly block people from housing, affordable insurance and other economic opportunities, as growing numbers of landlords, insurance companies and others evaluate and often discriminate against people on the basis of their credit histories.

Concerns About Financial Technology and the Emerging Cashless Economy

Cashless businesses, by their very nature, create an exclusive marketplace in which New Yorkers must accept the terms and conditions of private entities in order to participate. In refusing to accept cash, cashless businesses employ credit card companies, financial technology (‘fintech”) companies, and others to handle payment processing. Requiring people to rely on this private infrastructure simply to buy school supplies, food or medicine, for example, grants an inordinate amount of power to corporations that are more accountable to their investors than to New Yorkers and New York City communities.

Nationally, as a result of the persistent bank redlining discussed above and other structural inequities in our economy, close to 17% of Black households and 14% of Latino households don’t have a bank account, compared to an average among white households of only 3%.3 The consequences of these disparities are significant, especially as cashless businesses multiply.

Credit card and fintech companies, cashless enterprises, and other proponents of the cashless economy promote the benefits of a cashless economy without addressing the economic and racial injustice it perpetuates. Fintech companies are especially problematic. Many of these companies routinely circumvent state consumer protection laws — including those we have in New York — through “sham” partnerships with national and out-of-state banks; engage in risky securitization of loans; rely on broad and invasive data collection; employ racially-biased loan underwriting algorithms; and have been the subject of state and federal enforcement actions.

Especially now, as Amazon threatens to bring a wave of gentrification to Western Queens with its HQ2 development, and is considering a plan to open numerous cashless and cashier-less stores over the next few years, it is imperative that the Council look for ways to eliminate, not enhance, the serious financial burden on low-income New Yorkers and New Yorkers of color.

The Need for Bold Solutions to Address Our Two-tiered Financial System, Which Perpetuates Poverty, Inequality and Segregation in NYC

As I’ve outlined throughout this testimony, there are deep, structural inequities in our current financial system. Intro. 1281 is an important step in the right direction, ensuring no New Yorker will be excluded from the economy solely because they lack a credit card or bank account. The Council should support this bill as a part of a broad, bold platform to address inequality and segregation and our two-tiered financial system.

The Council should support efforts to democratize our economy, with and for communities that have been exploited and excluded from the mainstream financial system for decades. For example, groups around the city are actively organizing for increased funding for mission-driven community development financial institutions; for community land trusts and other non-speculative housing models; to strengthen and expand worker, food, financial, and other cooperatives; and to establish the first municipal public bank in the nation; and much more. There are many meaningful ways in which the City Council can support these efforts.

Thank you for your consideration. Please feel free to contact me with any questions: 212-680-5100 ext. 209, juleon@neweconomynyc.org

Maps

|

|

|

References

1. Disparities in Economic Security for New Yorkers of Color 50 and Older

2. 2015 FDIC National Survey of Unbanked and Underbanked Households

3. 2017 FDIC National Survey of Unbanked and Underbanked Households