News & Events

November

2018

28

Environmental & Community Groups Call on NYC to Divest from Banks that Fuel Climate Change and Establish a Public Bank

FOR IMMEDIATE RELEASE: November 28, 2018

CONTACT: Andy Morrison, 716-308-2265

ENVIRONMENTAL & COMMUNITY GROUPS CALL ON NYC TO DIVEST FROM BANKS THAT FUEL CLIMATE CHANGE AND ESTABLISH A PUBLIC BANK

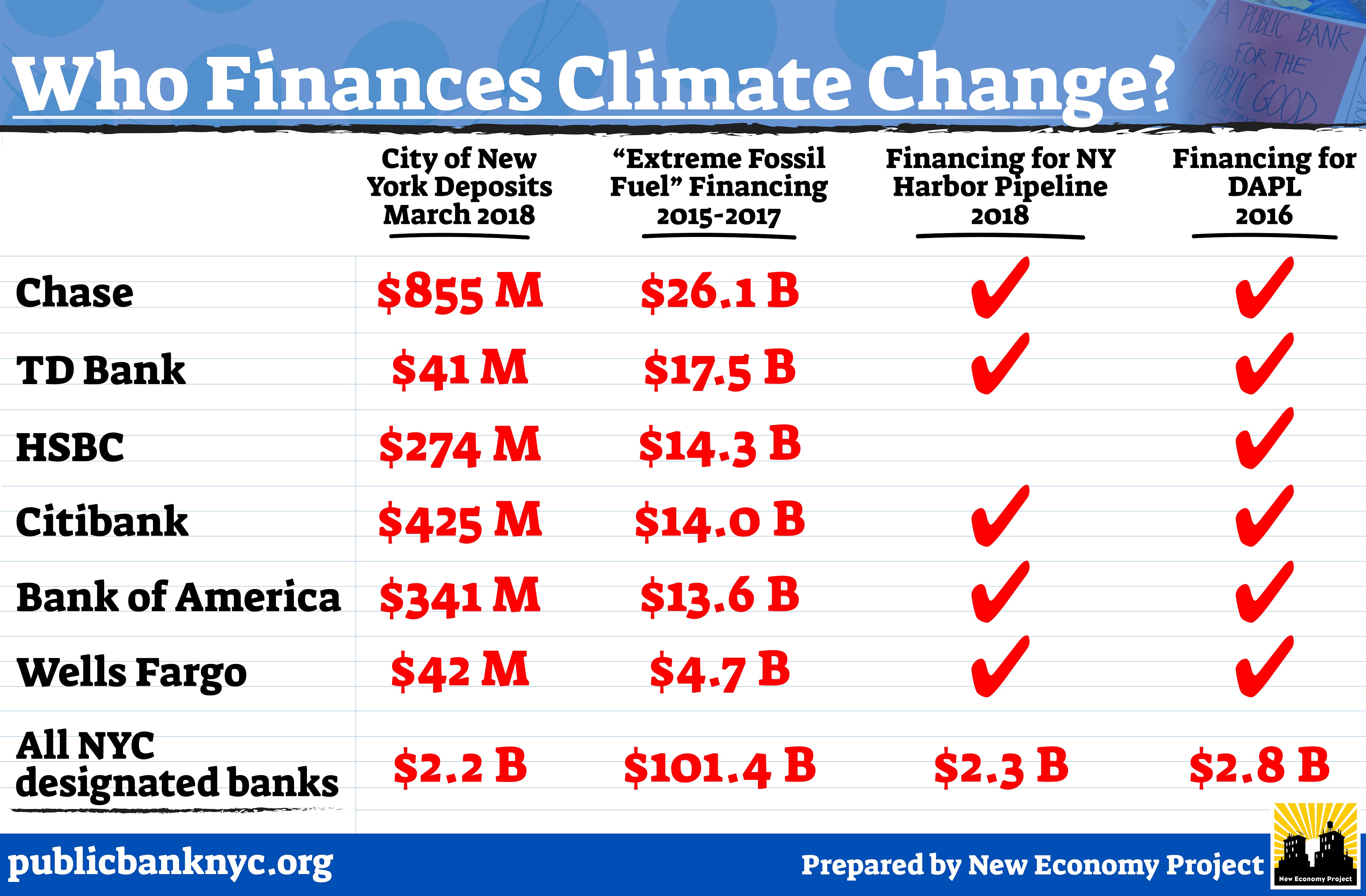

Coalition releases new analysis on 4th Annual Climate Finance Day, showing NYC’s designated banks invested $100+ billion in fossil fuels since Hurricane Sandy

NEW YORK, NY – As global leaders assemble for the United Nations-backed 4th Annual Climate Finance Day, New Yorkers, including representatives of environmental, community and student groups, rallied at City Hall and called on NYC to divest public money from banks that fuel climate change and to establish a municipal public bank to help fund the transition to a just, sustainable economy.

At the rally, Public Bank NYC, a broad coalition of community, worker rights, environmental, and economic justice groups, released new findings showing nine of the largest banks eligible to hold City deposits (“NYC designated banks”) are major investors in the fossil fuel industry, including the proposed Williams Pipeline, which would carry fracked gas across the New York Harbor.

Among the Coalition’s findings (see also attached chart):

- NYC’s designated banks committed more than $100 billion in financing for fossil fuel extraction since 2013.

- NYC’s largest designated banks increased their financing commitments to “extreme fossil fuel” companies by an average of 24.9% from 2016 to 2017. Notably, TD Bank more than doubled its financing commitments (106.7%).

- Despite JPMorgan Chase and HSBC’s stated policies to limit the companies’ lending to coal, oil, or gas projects, both banks showed sharp increases in their “extreme fossil fuel” financing.

- This year, New York City’s designated banks committed more than $2 billion in financing for The Williams Companies, which is attempting to build a new fracked-gas pipeline in NYC, despite strong opposition from New York groups.

“Each year, New York City moves tens of billions of public dollars through Wall Street banks. Not only do these banks exploit and extract wealth from low-income neighborhoods and neighborhoods of color, but they also fuel climate chaos through their investments in the fossil fuel industry,” said New Economy Project’s co-director Deyanira Del Rio. “Through a public bank, the City can divest from banks that profit from the destruction of our communities and our planet, and support permanently-affordable housing, community-controlled clean energy, and much more.”

“In every corner of our city there are businesses that are blocked from accessing financing from mainstream banks – from MWBE’s, to worker-owned cooperatives, to green technology startups, and even affordable housing initiatives,” said NYC Council Member Mark Levine. “Though we have made progress divesting from the fossil fuel industry, we must go further. Our City should put its own money to work for New Yorkers through a public bank, which would supercharge investments in critical projects throughout the five boroughs, and return financial power to the people and businesses that need it most.”

“In my South Bronx community, where asthma hospitalization rates are eight times the national average, we live and breathe a climate catastrophe,” said Mychal Johnson, co-founder of South Bronx Unite. “Our environmental and social justice advocacy is directly linked to community economic justice. We believe community-controlled alternatives are the solutions that move us away from fossil fuel power plants and diesel truck intensive enterprises that pollute, cause harm and negatively affect our local economic situation, where 49% of our children live at or below the poverty line and where unemployment rates are three times the national rate. We believe public banks and community land trusts are vehicles for sustainable, positive, economic change. We need our city and state administrations to work with us, and for us, to achieve true economic justice.”

“I have first-hand experience of the devastating effects of climate change.” said Rachel Rivera, member of New York Communities for Change, “During Hurricane Sandy the ceiling collapsed on me and my family. No one should have to live through that. New York City needs to do everything in its power to end climate change, and that includes creating a public bank so we can stop doing business with the banks funding the fossil fuel industry.”

“Wall Street banks are fueling climate change by investing in fossil fuel projects that are cooking our planet. And now our generation will inherit a planet whose climate is on the verge of devastation. That’s why we are calling for a Public Bank in New York City, so that renewable energy and sustainable transportation projects can be prioritized rather than pipelines. It’s time for public money to work for the public good,” said Evan Cedeño, NYPIRG member and student at NYC College of Technology.

“Chhaya has been working on the front-lines of many movements for justice, including environmental justice, affordable housing, and equitable financial services. Too often, private banks are unwilling or unable to achieve these objectives,” said Chhaya CDC’s neighborhood and housing preservation specialist, Silky Misra. “A public bank would move beyond the highly extractive, profit-driven status quo, and invest in transformative economic development projects that New York City’s communities of color need.”

Through a public bank, New York City can help transform the local economy and fundamentally change the City’s approach to economic development. The Public Bank NYC coalition is pressing for a public bank that would:

- Make equitable investments that support low- and extremely low-income housing, union and living wage jobs for New York City residents, democratically-controlled clean energy, public infrastructure, cooperative ownership, and small businesses, prioritizing minority and women-owned businesses and locally-based enterprises.

- Expand high-quality, affordable financial services to low-income and immigrant communities and communities of color, by partnering with nonprofit and mission-driven community development financial institutions, especially community development credit unions.

- Foster community wealth-building and neighborhood-led development, including by financing cooperative, not-for-profit and non-speculative models that provide long-term public benefit, such as community land trusts and worker co-ops.

- Promote transparency and accountability in municipal finance, including by providing comprehensive, non-extractive banking services and affordable municipal financing options to the City and its agencies.

For more information, visit: www.publicbanknyc.org