Blog

February

2018

23

They’re Banks, Right?

Posted by Alexis Iwanisziw and Sarah Ludwig

These days it seems taken for granted that banks discriminate against people and neighborhoods of color – they’re banks, right? We can thank the Center for Investigative Reporting for reminding the world that this is not okay. In its recent exposé, Kept Out, CIR documents banks’ and other mortgage lenders’ pernicious redlining in Philadelphia and 60 other cities across the country.

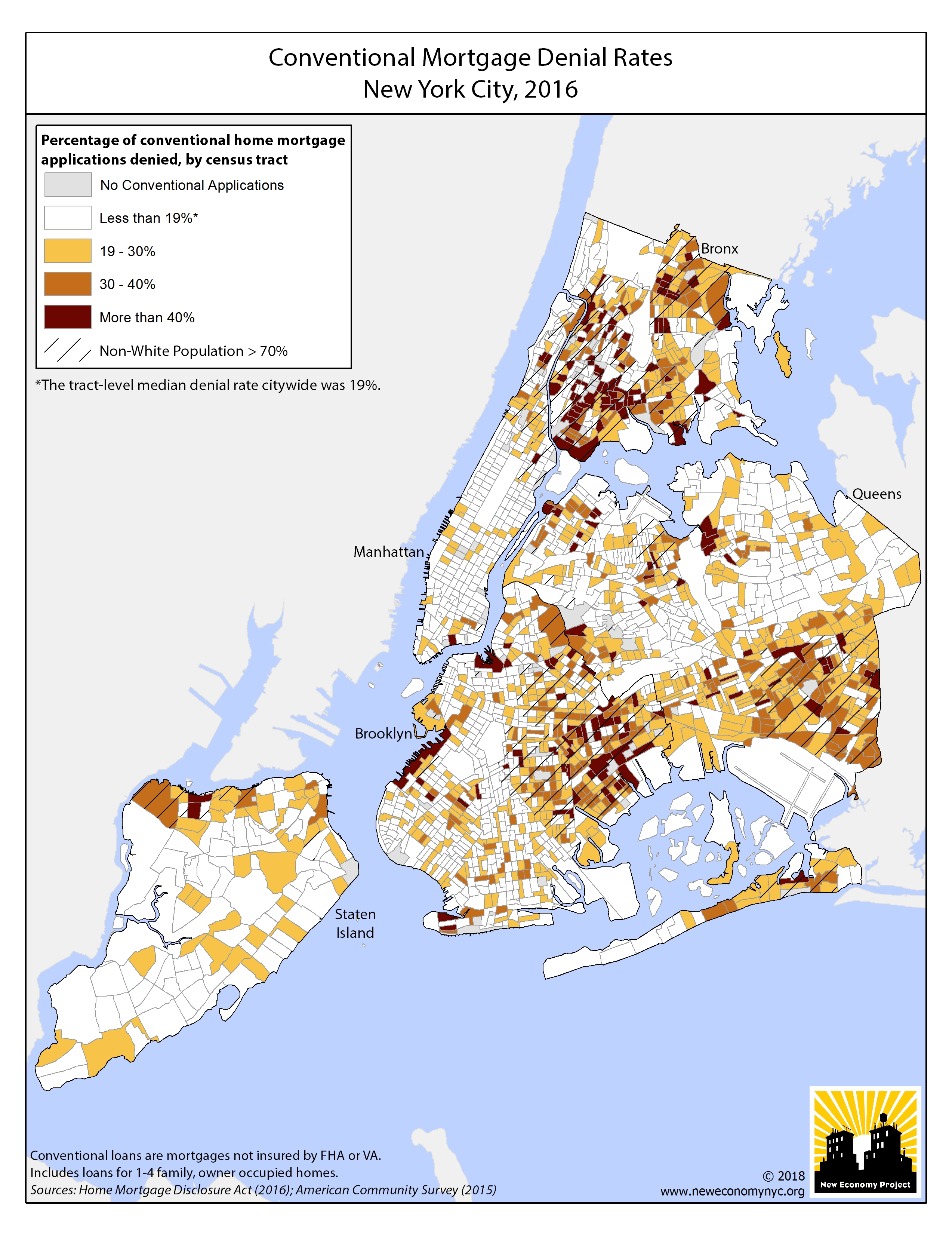

We noticed that the report does not cover New York City, where banks and other mortgage lenders have a long history of redlining communities and discriminating against New Yorkers of color. We decided to apply CIR’s methodology and map mortgage denial rates to see how the numbers shake out for New York City.[1]

What did we find for NYC?

Disparities by Neighborhood

Banks and other lenders were much more likely to deny mortgage applications for homes located in New York City communities of color. Three out of four neighborhoods where lenders denied more than half of applications received were communities of color.

In fact, banks and other mortgage lenders were significantly more likely to deny loan applications as the percentage of black or Latino residents in New York City neighborhoods increased – whether people applied for a mortgage to buy a home or to refinance an existing mortgage.

Disparities by Race & Ethnicity of Applicants

Similarly, we found major disparities in mortgage denial rates, based on applicants’ race and ethnicity.

For people applying for a mortgage to buy a home in New York City:

- Banks and other mortgage lenders denied black applicants more than twice as often as white applicants (26% vs. 12%). Controlling for income, loan size and other factors, the odds of banks and other mortgage lenders denying loans to black applicants were almost twice that of white applicants.

- Banks and other mortgage lenders denied Latino applicants nearly twice as often as white applicants (21% vs. 12%). Controlling for income, loan size and other factors, the odds of banks and other mortgage lenders denying loans to Latino applicants were more than 1.5 times that of white applicants.

We found similar denial rate disparities for New Yorkers seeking to refinance an existing mortgage:

- Banks and other lenders were more likely to deny refi applications from New Yorkers of color, even controlling for income, loan size and other factors.

- Banks and other lenders denied 53% of black, 44% of Latino, and 40% of Asian New Yorkers, compared to 30% of white New Yorkers.

What now?

The persistence of bank redlining and discrimination in New York City is of course troubling on its face. But bank redlining also lies at the very heart of neighborhood segregation, inequality, and poverty – and as intractable as discrimination by banks might seem, we need to keep fighting for a fair financial system, as a matter of racial justice and neighborhood equity.

Since the 1970s, we’ve had federal and New York State laws on the books that are meant to address bank redlining. The laws state that banks have an affirmative legal duty to serve all communities equitably, by providing services, loans and investments, within the bounds of safe and sound banking. We have only to look at entrenched patterns of bank redlining, however, to see that these laws have proven woefully inadequate.

Meanwhile, as the Trump administration shamelessly dismantles already inadequate financial services regulations, it’s now more critical than ever for New York City and State to step up and take on the banks.

New York has tremendous leverage over the big banks that dominate the field. For starters, New York City and State both have billions of public dollars on deposit with the big banks – not to mention our public pension fund investments and myriad contracts. As an obvious step, New York should divest from financial institutions that are actively harming New Yorkers and New York neighborhoods.

Where to put that money once we divest? In a public bank, of course!

# # #

Check out our map gallery here.

[1] New Economy Project analyzed 2016 Home Mortgage Disclosure Act data for New York City, including all loan applications for conventional home purchase and refinance loans on owner-occupied, 1-4 family homes.