Blog

February

2017

27

Asleep at the Wheel: Why Does New York Let Car Insurance Companies Discriminate Against Drivers?

Posted by Raúl Carrillo and Sarah Ludwig

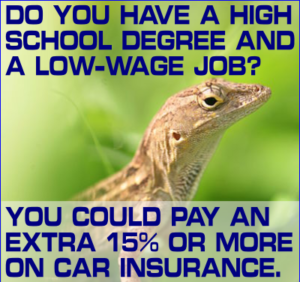

Car insurance is unaffordable to 5.2 million New Yorkers, according to a report just issued by the U.S. Treasury’s Federal Insurance Office (FIO). But car insurance is not only expensive for New Yorkers – its pricing is also fundamentally discriminatory. That’s because New York allows car insurance companies to consider factors like a person’s education and occupation in determining how much to charge for coverage – even though these factors bear no relation to a person’s actual driving record or to public safety more broadly.

These non-driving-related factors effectively function as proxies for race and income, since education and occupation are largely stratified by race and income. Allowing car insurers to use such factors unfairly penalizes New Yorkers of color. It especially penalizes low-income women of color, who routinely pay more for car insurance, no matter how perfect their driving record. Indeed, NYPIRG found that by giving priority to these non-driving factors over people’s driving records, car insurance companies in New York engaged in unfair discrimination against New Yorkers of color.

These non-driving-related factors effectively function as proxies for race and income, since education and occupation are largely stratified by race and income. Allowing car insurers to use such factors unfairly penalizes New Yorkers of color. It especially penalizes low-income women of color, who routinely pay more for car insurance, no matter how perfect their driving record. Indeed, NYPIRG found that by giving priority to these non-driving factors over people’s driving records, car insurance companies in New York engaged in unfair discrimination against New Yorkers of color.

In fact, New York scored among the very worst states in the country, according to the FIO, with more than 60% of New Yorkers living in low and moderate income communities and communities of color unable to afford car insurance. In one South Bronx zip code, the typical driver spends a staggering 9% of her income on car insurance. And Consumer Federation of America found that people in the NYC area who have good driving records and live in predominantly African-American neighborhoods pay 83% more than their counterparts in neighborhoods with relatively few African-American residents.

It’s high time for New York to end this blatant discrimination.

We call on New York’s insurance regulator, the Department of Financial Services (DFS), to prohibit car insurance companies from considering New Yorkers’ education and occupation when pricing coverage. Car insurance companies can provide coverage and accurately price risk without these factors. Take California, for example, which restricts insurers from using these non-driving-related factors. Car insurance in California is considered affordable to 99% of the state’s residents, and the market is still regarded as one of the most competitive in the country.

Most car insurance companies in New York also consider people’s credit histories in pricing, and economic justice groups have long called for an end to this form of redlining as well. New York would need legislation, however, to ban the use of credit history in insurance pricing. By contrast, DFS has clear authority to ban car insurers’ use of educational and occupational information, and should do so immediately.

Ending this economic injustice is a matter of basic fairness, and DFS holds the key.

—

Take Action! Tell DFS to prohibit insurers from using people’s education and occupation to price New Yorkers’ car insurance. Click here to tweet your message @NYDFS.