Publications

June

2013

6

The Debt Collection Racket in New York

The Debt Collection Racket in New York: How the Industry Violates Due Process and Perpetuates Economic Inequality

Over the past decade, the number of debt collection lawsuits filed in New York’s courts has exploded, with upwards of 200,000 cases filed in 2011 alone. Creditors and debt buyers engage in an array of fraudulent and deceptive debt collection practices that siphon billions of dollars from New York’s low-income neighborhoods and communities of color. Abusive debt collection falls along a continuum of discriminatory financial practices that pervade low-income neighborhoods and communities of color, long targeted by high-cost and predatory financial services providers.

The creditors and debt buyers that bring these lawsuits routinely engage in “sewer service” — falsely claiming to the courts that they have served people with court papers. They also engage in rampant “robo-signing” — mass-producing fraudulent documents that they then submit to the courts. Debt buyers — companies that buy old, charged-off debts for pennies on the dollar — file more than half of all debt collection lawsuits in New York, and systematically lie to the courts about key information that they do not in fact have.

Creditors and debt buyers engage in this fraud to obtain automatic, or “default,” court judgments, which they then use to freeze people’s bank accounts or garnish their wages. The judgments also appear on people’s credit reports, blocking them from housing, employment, and credit access. Consequences have been especially dire for low-wage workers, elderly and disabled New Yorkers on fixed incomes, single mothers, and domestic violence survivors — and now also New Yorkers affected by last year’s hurricane.

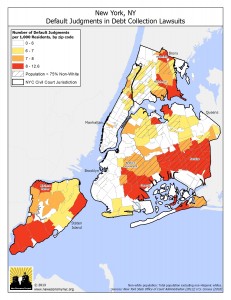

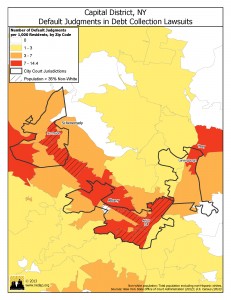

The report includes maps showing the concentration of default judgments in communities of color:

|

|

|

| New York City | Capital Region |

Recommendations:

Fundamental change is urgently needed to bring about a financial system based on principles of economic equity, fairness, and inclusion. There are straightforward measures New York can take now to significantly curb abusive debt collection practices and ensure due process for New Yorkers, including:

- New York should enact the Consumer Credit Fairness Act (S.2454/A.2678), which would ensure fundamental due process for New Yorkers sued by debt collectors.

- The New York State Office of Court Administration (OCA) should implement strong rules to prevent debt buyers from using the courts to collect on debts without having the proof that New York law requires.

- The NYS Attorney General and DFS should take aggressive enforcement action against debt buyers that violate federal and state fair debt collection and other consumer protection laws.

- The Consumer Financial Protection Bureau should use its authority over banks and debt collectors, and the Office of the Comptroller of the Currency should use its authority over national banks, to crack down on abusive practices in the sale and collection of debts.

See also: Debt Deception: How Debt Buyers Abuse the Legal System to Prey on Lower-Income New Yorkers (May 2010)