Blog

August

2019

27

No More, Encore (take two)

Posted by Nick Loh and Sarah Ludwig

Seems New Economy Project has struck a nerve. This year, Encore Capital, the country’s largest publicly-traded debt-buying company, blocked us from speaking at its annual shareholder meeting – even though our organization is a full-fledged shareholder in the company.

Perhaps Encore was less than thrilled about our presentations at last year’s shareholder meeting, when we spoke out about the company’s deplorable debt collection practices; played an audio recording we’d made featuring Esther Roman, a 60-year-old grandmother who described how the company had mistreated her and disrupted her life; and served Encore with a mock Summons and Complaint, for engaging in discriminatory and abusive debt collection to the detriment of thousands of low-income New Yorkers.

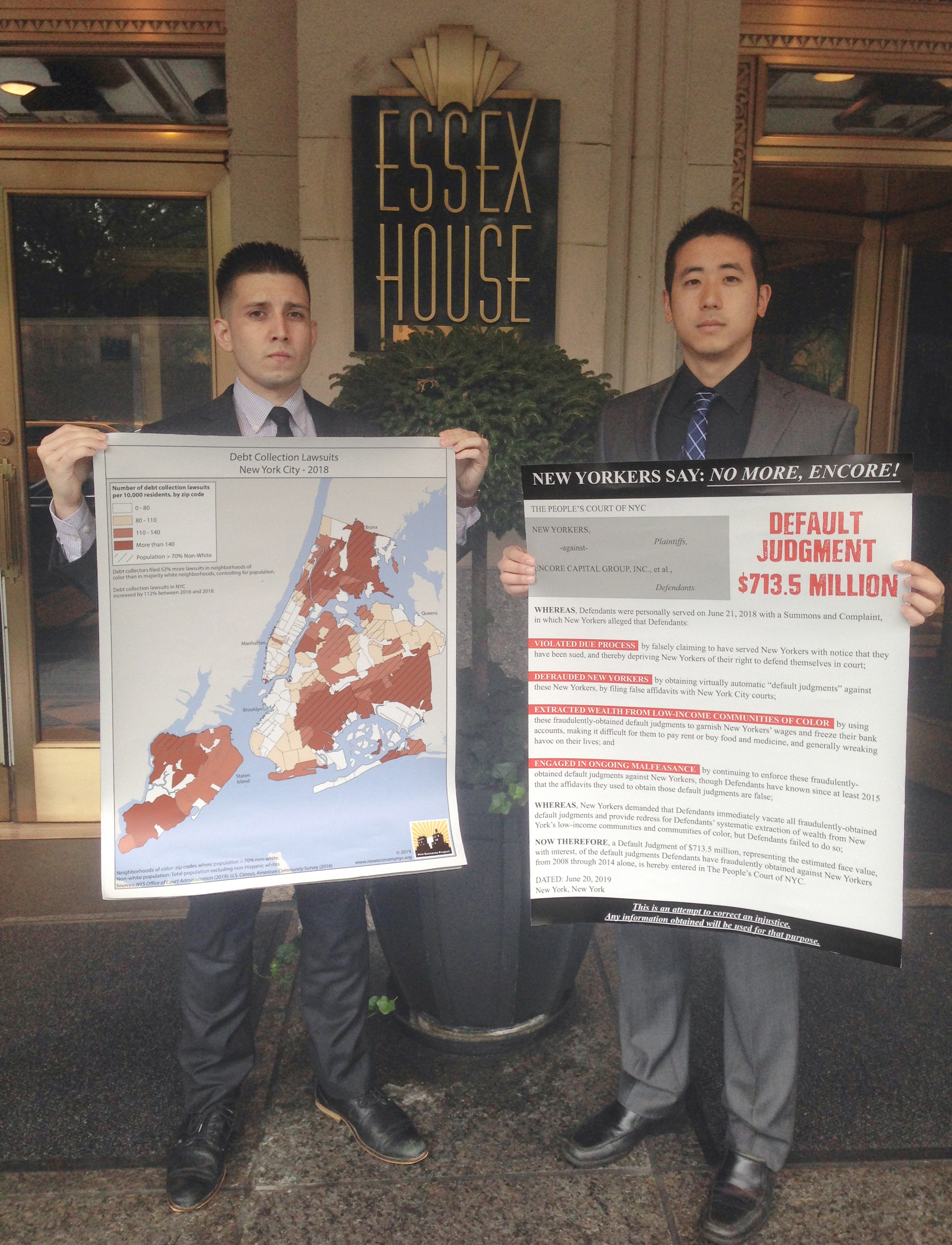

Debt buyers like Encore and its many affiliates specialize in extracting wealth from low-income people and communities. They do this by suing people, failing to notify them that they’ve sued them (in other words, violating people’s basic due process), and obtaining “default judgments” against them. They then use these default judgments to freeze people’s bank accounts and garnish their wages. So this year, we came to the meeting prepared to enter a default judgment against Encore (ceremoniously, of course), for failure to respond to last year’s “Summons.” We also had in hand a poster-sized map showing the overwhelming concentration of debt collection lawsuits in NYC communities of color.

But before we’d even found our way to our seats, Encore’s meeting facilitator moved to adjourn the meeting. We raised our hands and walked to the front of the room, identified ourselves as shareholders, and indicated that we would like to speak. A senior vice president asked us what we planned to say. We explained we were there, as shareholders, to speak about Encore’s debt collection practices. First he said we could not speak because our item was not on the agenda – even though the agenda has a section for shareholder Q&A. Then he made the absurd point that our speaking about the company’s debt collection practices was unrelated to the company’s business.

As our legal director reiterated our status as shareholders and the obvious relevance of debt collection to the company’s business, the V.P. continued to prevent us from speaking, now claiming it was unfair to other shareholders for us to speak – though, as we later learned, we were the only actual shareholders in the room! The board then moved to end the meeting, got up, and left the room.

Watch the videos below to hear what we would have said, had this notorious company permitted its shareholders to speak, and click here for a closer look at our maps depicting the concentration of debt collection cases and default judgments in NYC’s low-income communities and communities of color.

,