Blog

March

2016

24

Hey OCC: You Don’t Write, You Don’t Call…

It’s been four months, and still no reply. Last November, New Economy Project and 15 social justice organizations filed a detailed letter with the OCC, JPMorgan Chase’s banking regulator, calling on the agency to give Chase a failing grade on its community reinvestment exam.

Every few years, banks’ regulators evaluate how they are performing under the Community Reinvestment Act (CRA), which states that banks have a continuing and affirmative duty to serve the credit needs of all communities equitably, including low- and moderate-income neighborhoods, within the bounds of safe and sound banking. Under this law, community groups and the public at large are encouraged to submit comments on banks’ community reinvestment performance, as part of the CRA exam process.

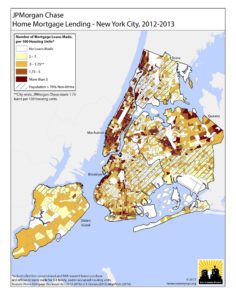

Our organizations have lots to say about Chase’s failure to serve all communities equitably. Even worse, we have lots to say about how Chase is actively harming New Yorkers and NYC neighborhoods. Indeed, our letter is chock-full of case examples, data findings, and a map showing Chase’s redlining of NYC neighborhoods. It even caught the interest of The New York Times, which cited it in a lengthy article about banks’ failure to fairly serve immigrants in NYC.

New Economy Project and allies pointed to four ways that JPMorgan Chase is failing to serve NYC neighborhoods and residents equitably :

- Chase Redlines Low-Income Neighborhoods and Neighborhoods of Color. Chase has by far the highest number of branches in NYC, but has left vast swaths of the city – particularly immigrant and low-income neighborhoods of color – with few or no branches. New Yorkers living in white neighborhoods have access to twice as many Chase branches as people who live in communities of color. Chase’s mortgage lending also shows racial disparities at all income levels. The bank makes few home loans to New Yorkers who live in communities of color — including homeowners in middle- and upper-income predominantly black neighborhoods of St. Albans, Rosedale, Springfield Gardens and Laurelton, in Southeast Queens.

- Chase Refuses to Accept NYC’s Municipal ID. Rolled out in 2015, NYC’s municipal identification card program (“IDNYC”) has given all New York City residents access to free, secure, government-issued photo ID. Even though regulators have given banks the green light to accept IDNYC cards as primary ID to open accounts, Chase has rejected IDNYC outright. Chase’s refusal to recognize IDNYC cards has a discriminatory impact on immigrant and homeless New Yorkers, among others who face barriers to obtaining other forms of ID and opening bank accounts.

- Chase’s Abusive, High-Cost Overdraft Program Violates the Community Reinvestment Act. In the first half of 2015, Chase collected $871 million in overdraft fees from its customers, and charged more in overdraft fees in the first quarter of 2015 than any other bank in the country. Chase’s overdraft program drains millions of dollars from lower-income New Yorkers who bank at Chase, and discourages many others, including people without a bank account, from opening accounts at Chase.

- Chase’s Mortgage Servicing and Foreclosure Abuses Persist. Chase is obligated, under a number of settlement agreements, to provide affordable loan modifications to struggling homeowners. Despite this obligation, Chase has frequently mistreated low-income homeowners and failed to provide basic accommodations to allow distressed homeowners to stay in their homes. Servicing about $1 trillion in mortgages, Chase is among the largest mortgage servicers in the country, and the bank’s abusive mortgage servicing and foreclosure practices have prolonged the foreclosure crisis for too many people trying desperately to hold onto their homes.

With more than 40% of all deposits in NYC, Chase is far and away the city’s largest bank. Its failure to provide fair banking access and invest meaningfully in communities of color – where most of the City’s population lives – has a huge negative impact on NYC neighborhoods and residents, and ultimately serves to perpetuate inequality and poverty. Simply put, there’s a ton at stake for NYC communities, but here we are in March, and still not a peep from the OCC.

New Economy Project and allies also filed a comment letter in 2010, when the OCC was conducting Chase’s last CRA exam. In the 2010 letter, we similarly presented the OCC with hard evidence showing how Chase was failing to serve NYC communities equitably. But you’d never know from the OCC’s performance evaluation that community groups had even weighed in. In fact, the OCC ended up granting Chase an ‘Outstanding’ CRA rating for the NY region, and completely disregarded the fact that Chase was manifestly harming NYC neighborhoods through redlining, destructive foreclosure practices, and the like. This travesty underscores that we need to hold regulators, as well as banks, accountable.

This time around, we hope the OCC pays heed to our letter, which comes from organizations and people who see first-hand how JPMorgan Chase fails to meet its affirmative legal duty to serve all communities equitably. We are just a phone call away if you want to reach us.

###

New Economy Project filed the comment letter along with the following organizations: ALIGN, Bedford-Stuyvesant Community Legal Services, The Black Institute, Chhaya Community Development Corporation, Foreclosure Resisters, Grow Brooklyn, Legal Services NYC, Legal Services NYC – Bronx, New Economy Project, New York Communities for Change, Picture the Homeless, Queens Legal Services, Retail Action Project, Right to the City Alliance, South Brooklyn Legal Services, Staten Island Legal Services.